Bank Account Payouts

Payment Provider Setup & Payouts

Chewzie processes online credit card payments on behalf of the store, hence signing up to a separate payment gateway provider is not required. To allow payments for online purchases to be passed on to the store, bank account details are required to be registered in the Chewzie Back Office.

The bank account is registered as a Payment Provider within back office and is required to be configured and verified before orders can be paid for and processed online.

Intended Audience

The setup instructions described in this document are intended for Business Owners or Financial Officers authorised to manage the bank accounts on behalf of the Business. Access to bank account details and business registration documentation is required.

It is assumed that the audience has access to the Chewzie Back Office application.

Prerequisites

In addition to having an authorised login to the Chewzie Back Office web application, the following information is required in order to complete the setup:

Business Requirements:

-

Registered business name

-

Business ABN

-

Business bank BSB

-

Business bank Account number

Identity Requirements:

-

Director information - Name and email

-

Owner information - Name and email

-

Account Representative - Name, email, DOB, Home Address, Phone Number

Bank Account Payouts Setup

The following sections describe the setup necessary to configure Bank Account Payouts. Business and Bank Account details will be captured. These details will undergo a verification process.

App Payment Account

The Bank Account is configured as a Payment Provider in the Chewzie back office .

Follow these steps to add a new payment provider.

Step 1. Navigate to: 'Chewzie Ordering', then click 'Payment Providers' under 'Payments'.

NOTE. The user who creates the Payment Provider will gain administrative privileges over the account. They will be the only user who can administer the account including changing the Bank Account details, and removing the account from an active Web App.

Step 2. Click the 'Actions' button, then select 'Add and Verify Payment Provider' to add a new App Payment Account.

Step 2. Click the 'Actions' button, then select 'Add and Verify Payment Provider' to add a new App Payment Account.

The following fields are required to be populated:

The following fields are required to be populated:

-

Name: Internal identifier for the App Payment Account.

-

Holder Type: Indicates if the APN is for a company or an ABN.

-

Holder Name: Registered Name with ASIC.

-

BSB: Bank Account BSB for payouts.

-

Account Number: Bank Account Number for payouts.

Step 3. Click 'Add Payment Account And Verify' to save the record and start the verification process.

NOTE. No bank account details are stored within Chewzie and leverages the services of the Stripe payment platform to handle the verification process.

Bank Account/Business Verification

Once the App Payment Account has been created, a verification process is initiated to verify the Bank Account and Business. This needs to be completed before payouts are granted.

-

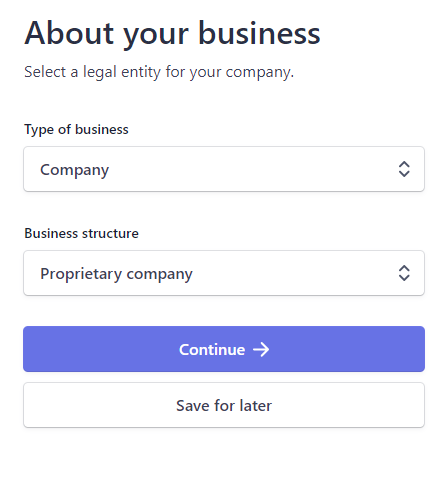

Update the type of business organisation

NOTE. 'Save for Later' can be selected, but the account will only be valid for 48 hours, and you will not be able to receive payouts. Test transactions can be performed, however it is not recommended to process live payments until the verification process has been completed.

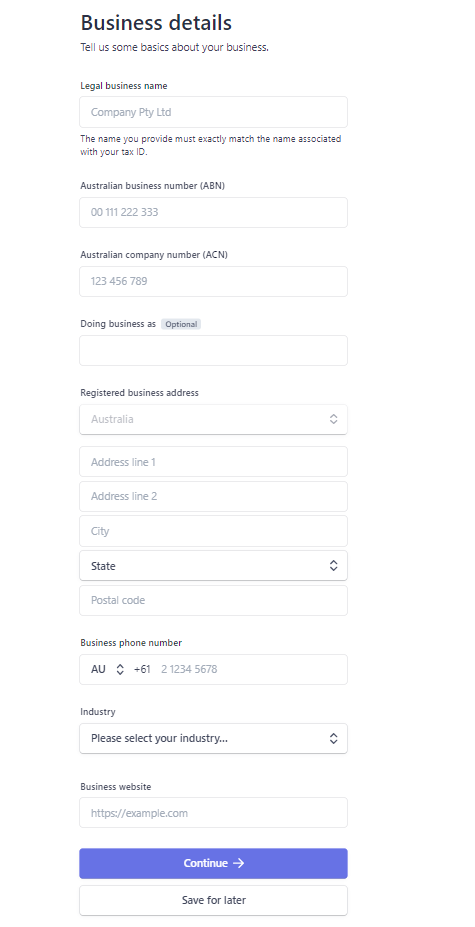

2. Enter in the company's business details

Note: The legal business name and ABN/ACN must match with the Australian Business Registry (ABR). This can be verified at https://abr.business.gov.au/. Mismatched ABNs will require further verifications and documentation to be provided.

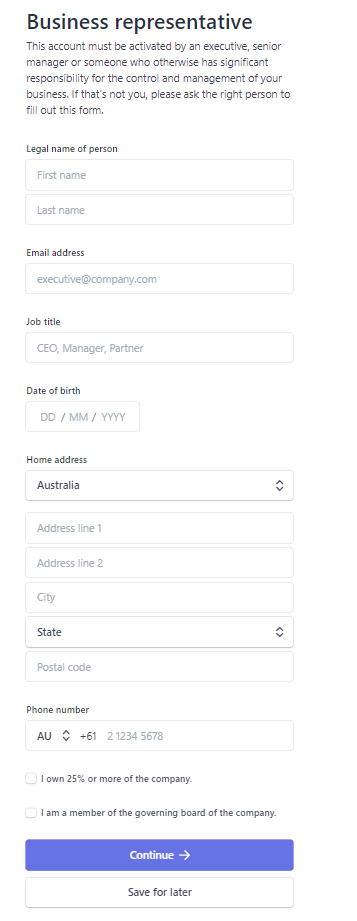

3. Add in the Business representative's details. This person does not have to be a director or an owner.

NOTE. If you tick 'I own 25% or more of the company', you will skip step 4.

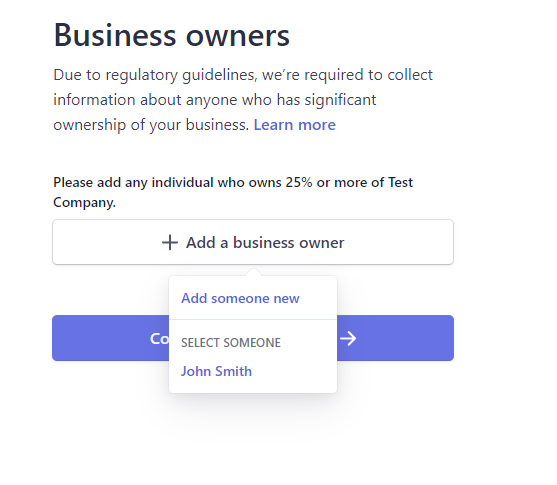

4. Add a business owner

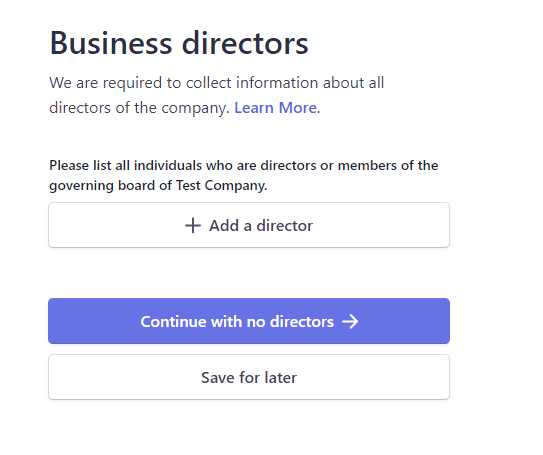

5. Add a Business Director

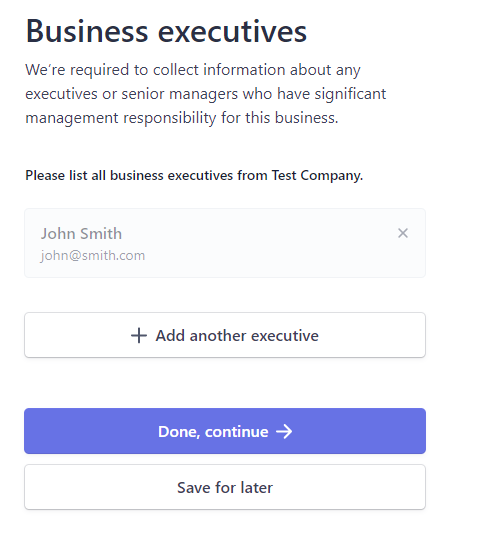

6. Add any business executives.

Once the forms are complete, if all of the data has been filled out completely, then then Stripe will direct back to Chewzie.

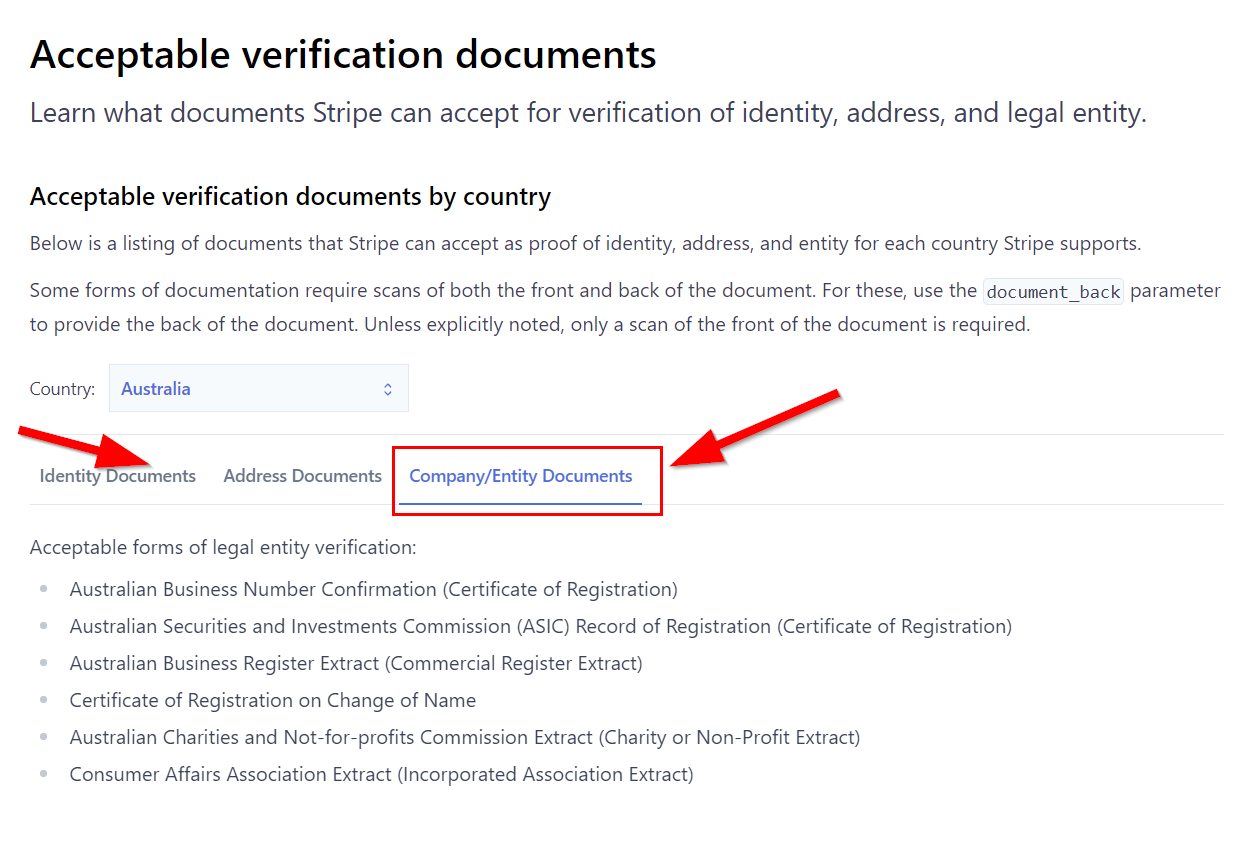

If there are any verification issues, you will be asked to supply supporting verification documents.

You should not need any verification documents, if you are asked, it probably means you have entered something in wrong.

-

Check Name is the Customer's legal name.

E.G Johnny Chang is actually Xe Jui Chang legally

-

Check the Customer's DOB is correct

-

Check the Business Name matches the ABN lookup Business Name

Examples of acceptable verification documents are below.

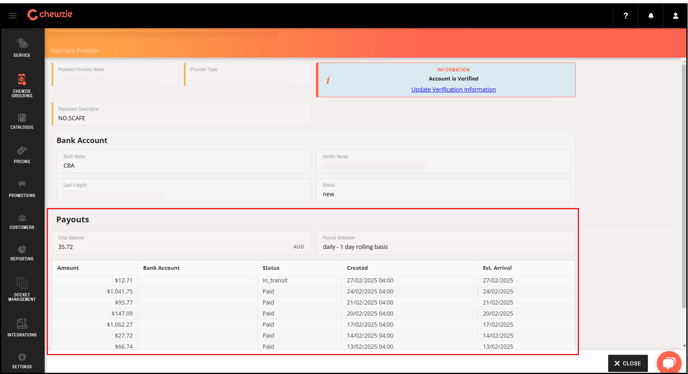

Verification Status

Once all of these details have been entered, it might take 24-48 hours for the verification to complete..

The status can be reviewed on the 'Chewzie Ordering', then click 'Payment Providers' under 'Payments'. The bank details will reflect in the 'Bank Account' section.

The verification status will also be shown if the account is verified.

If the account is not yet verified then a link will be shown to resume the verification process and a warning message will be visible:

If the account is not yet verified then a link will be shown to resume the verification process and a warning message will be visible:

NOTE. Only the user who created the App Payment Account will be able to view the link.

The bank account can be changed by clicking

![]()

NOTE. To prevent possible payment disruption during the verification process, please consider creating a new App Payment Account instead of changing the bank account of an existing one.

Associate Payment Account with Web App

Once the Payment Provider has been verified it is ready to be used to process payments. It can be associated with the Web App. Once this is saved, and live mode is selected, the Web App will start processing payments to the bank account.

Step 1. In the Chewzie back office web application navigate to: 'Chewzie Ordering' the click 'Web App'.

Step 2. Under 'Payments and Service', enable the 'Live Payment Mode', then select the Payment Provider from the drop down.

Step 3. Next is to assign the payment provider in the store. Go to 'Chewzie Ordering', then under 'Web App', click on 'Stores'. Then click on the store where the payment provider will be assigned.

Step 4. Click on 'Detailed View' then scroll to 'Cash Management'. Select the payment provider from the 'Payment Settings' drop-down.

Step 4. Finally, click 'Save Store' to complete the process.

NOTES.

- "Live Payment Mode” needs to be enabled to process real payments. Otherwise the Web App will be in a test mode and can only process payments using test credit card numbers.

- While anyone can add the App Payment Account to the App, only the account owner can unselect the App Payment Account.

- If the info panel does not indicate “Using Chewzie Payment Platform”, then the Chewzie application has not been set up to process payments. Please contact a member of support to assist.

Payout Status

The status of bank payouts can be viewed on the App Payment Account. The payouts are configured to be paid out as soon as possible which is a minimum of 48 hours in Australia. The last 10 payouts will be listed.

NOTE. Updating the bank details in your back office does not change the bank account where the monthly minimums will be debited from so you need to set up a different bank account where Chewzie fees can be withdrawn. Please contact Support or your Success Manager for assistance.